The Revenue Authority has collaborated with e-commerce websites to combat the sale of unapproved items.

Following the Customs Department’s signing of memorandums of understanding with online sales platforms to work together in monitoring and preventing the importation of illegal items or those that do not meet legal requirements, Phantong Loykulnanta, director-general of the department, stated that this collaboration should decrease the availability of low-quality products.

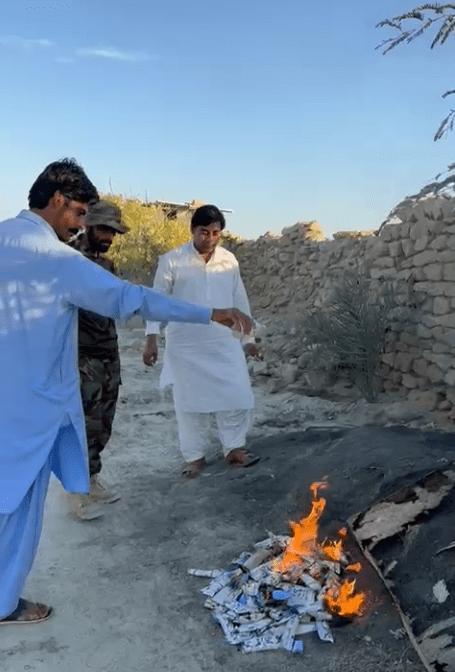

The emphasis is on products that do not have standard certifications, like those from the Thai Industrial Standards Institute or the Food and Drug Administration, as well as banned items such as e-cigarettes, found on online marketplaces.

“I think finding imported products that lack certification standards, or banned items on online marketplaces, will become harder. For instance, searching for the term ‘e-cigarettes’ might not show results anymore, unless vendors use different keywords,” Mr Phantong stated.

In Thailand, 23 organizations are licensed to provide product certifications across different fields, such as industrial specifications and food and medication standards.

Starting January 1, 2026, imported items that have a minimal value, beginning at just 1 baht, will be liable for import taxes and value-added tax (VAT).

He mentioned that in fiscal 2025, which has just concluded, there were 160 million low-value imported goods (valued under 1,500 baht), with approximately 90% sold through online marketplaces.

The implementation of taxes on de minimis goods from next year is anticipated to bring in an extra 3 billion baht in yearly revenue for the department. Import duty rates differ depending on the product category. For instance, clothing and shoes are subject to a 30% import duty, whereas bags are taxed at 20%.

As to whether the new tax collection would place a greater load on consumers, Mr. Phantong stated that it depends on the platform.

Certain platforms might transfer the tax by including it in product costs, whereas others could decide to bear the tax themselves.

He mentioned that the extra tax burden should be considered in relation to the necessity of maintaining fair competition, as imported goods were previously not taxed, while local businesses have always had to comply with local tax requirements.

“The imposition of taxes on low-cost imported items aims to establish a new framework that promotes more equitable competition for Thai small enterprises,” stated Mr. Phantong.

Thamakorn Supathanarangsri, vice-president and head of government affairs at Lazada, stated that the company is not worried about the tax and thinks it won’t impact online sales figures. Regarding pricing, he mentioned that it relies on the promotional tactics used by individual sellers.

Provided by SyndiGate Media Inc.Syndigate.info).

Leave a comment