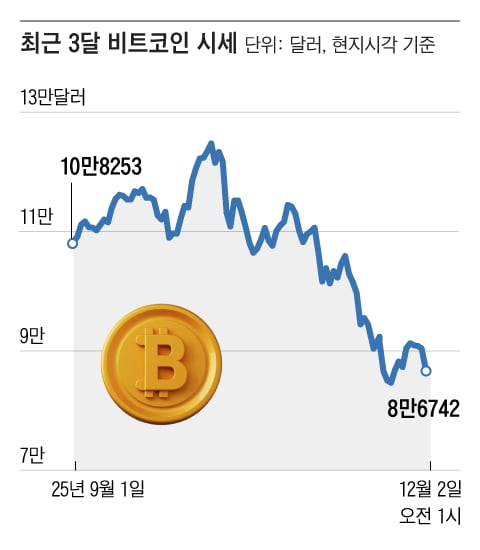

Bitcoin, the top cryptocurrency, has experienced a continuous drop in value, as funds exit the crypto market similar to a receding tide.

As per Coinbase, the U.S. cryptocurrency exchange, Bitcoin’s value was $83,800 per coin at 12:45 a.m. Eastern Time on the 2nd, marking a decrease of almost 8% compared to 24 hours prior. Ethereum, the second most valuable cryptocurrency in terms of market capitalization, also dropped by more than 7%, trading at approximately $2,700 per coin. On the 1st, shares of Coinbase and the online trading platform Robinhood both declined by over 4%, while Strategic, the world’s biggest corporate Bitcoin holder and a representative indicator for the asset, experienced a 12% drop in its stock during intra-day trading.

Bitcoin, which reached an all-time high of $126,000 per coin in October, has since dropped more than 30% from its peak. Investor sentiment, already weakened by worries about an AI bubble and postponed U.S. interest rate reductions, continues to lack clarity. Nick Percrin, co-founder of Coin Bureau, stated to Yahoo Finance, “This is the first downturn since August last year,” and noted, “History tends to repeat itself, so it’s wise to anticipate increased fluctuations.”

◇ Concerns Regarding the Unraveling of the Yen Carry Trade Agitate the Market

The crypto market’s stagnation was largely driven by hints from Bank of Japan (BOJ) Governor Kazuo Ueda about a possible increase in interest rates on the 1st. During a financial and economic briefing in Nagoya, Aichi Prefecture, Ueda mentioned, “We will assess the advantages and disadvantages of increasing the policy rate at the next Monetary Policy Meeting,” adding, “Adjustments should not be either too late or too early.” His comments were seen as an official indication that rates might rise from 0.5% to 0.75% during the Monetary Policy Meeting scheduled for the 18th–19th of this month. As a result, Japan’s 2-year government bond yield, which is responsive to monetary policy, exceeded 1% annually, while the yen gained strength, causing turbulence in financial markets.

Worries that increasing borrowing costs in Japan might undermine the “yen carry trade” have affected the outlook for risk-related investments. Global liquidity, which was previously obtained through low-cost yen and allocated to high-return assets such as cryptocurrencies, could potentially decrease.

Rumors that Strategic, which manages around $56 billion in Bitcoin, is about to sell off have also put pressure on the market. Phong Le, CEO of Strategic, mentioned in a recent podcast that if the mNAV (company value divided by Bitcoin holdings ratio) drops below 1, the company could sell Bitcoin to support dividend payments. The mNAV has already decreased to 1.15. Strategic’s stock, which serves as an indicator for Bitcoin, has declined more than 60% from its peak in July, while an exchange-traded fund (ETF) designed to double the stock’s daily returns has fallen more than 90% since the beginning of the year.

◇ PBOC: Stablecoins Are Prohibited

China’s central bank also entered the virtual asset market. In a joint statement released on the 29th of last month with 13 government agencies, including the Ministry of Public Security, the People’s Bank of China (PBOC) labeled stablecoins as illegal financial activities, noting, “They present significant risks related to fraud, money laundering, and unauthorized capital flows.” The PBOC criticized stablecoins for not adhering to customer identification and anti-money laundering requirements.

The South China Morning Post noted this as the first instance where the Chinese government has formally banned stablecoins. Reuters reported on the 1st, referencing sources, that Chinese securities authorities instructed certain local securities companies to stop real-asset tokenization initiatives in Hong Kong. This information, released over the weekend, led to a decline in crypto-related stocks in Hong Kong on the 1st, which also had a negative effect on the overall cryptocurrency market.

Nevertheless, certain U.S. investment banks continue to see cryptocurrencies as a feasible part of investment portfolios. Chris Hyzy, the Chief Investment Officer (CIO) at Bank of America (BoA), mentioned in an investor note dated the 1st, “For investors who are interested in innovation and open to volatility, we suggest allocating 1–4% of total assets to digital assets.”

Leave a comment