Sudan’s oil industry is nearing a breakdown as the conflict between the military and the Rapid Support Forces (RSF) expands near key facilities in the western parts of the nation. Combat, drone attacks, and political disputes have consistently disrupted pipeline activities that transport oil from South Sudan, as well as production in West Kordofan State.

As stated by Energy Minister Mohamed Abdallah, Sudan has experienced a loss of approximately 50% of its oil output since the conflict began in mid-April 2023.

Before the conflict, Port Sudan generated approximately $146 million each month in transit and handling fees for crude oil transported from South Sudan. Estimated production data indicates that the conflict has affected pipelines, possibly lowering this amount to $48 million at most.

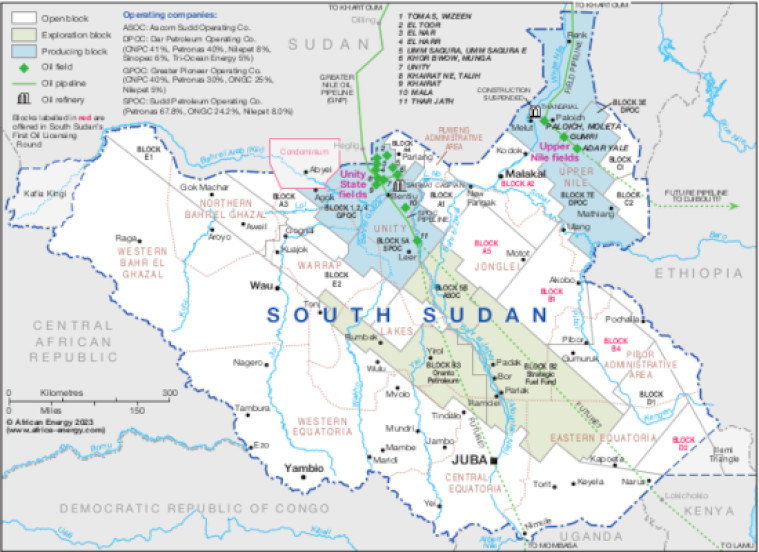

In March 2024, Sudan’s Ministry of Energy invoked force majeure on oil exports following a significant pipeline rupture triggered by the ongoing conflict. For seven months, Sudan did not receive any income from transit fees for South Sudan’s oil, while Juba experienced an estimated loss of $7 million daily in oil revenue. Oil shipments from South Sudan to Sudan resumed only in late December 2024, operating at half the pre-war level, decreasing from approximately 150,000 barrels per day (bpd) to 90,000 bpd.

The RSF took control of the Balila field two and a half years ago, bringing oil fields in West Kordofan—previously seen as safe from direct fighting—into the conflict. Industry experts caution that the RSF could now focus on the Heglig field, one of the army’s remaining key positions in the area.

Tensions between Juba and Port Sudan

A representative from the Sudanese Oil Workers Association informed Ayin that the security impact of the conflict has put pressure on ties between Khartoum and Juba, highlighting claims from Sudanese authorities that South Sudan “has not stayed neutral” and could be supporting Emirati-connected initiatives linked to the Rapid Support Forces.

An energy researcher named Hani Osman stated that Sudan is now approaching the transit of South Sudanese oil through a political perspective, urging Juba to keep its position against the Rapid Support Forces. Even with multiple attacks—including drone strikes on Heglig in mid-November—oil shipments have remained ongoing. South Sudan currently produces approximately 70,000 barrels daily, which is around 63% of its output before the war, transporting it from the Palogue fields to Bashair port through Sudanese territory.

However, reliability has significantly dropped, even at this reduced production rate. A worker based in Heglig cautioned that oil flows from South Sudan “could be interrupted at any time as long as tensions persist between the army, the Rapid Support Forces, and the Salva Kiir administration.”

A diplomatic source informed Ayin that during talks in October 2025, officials from Port Sudan conveyed to South Sudan’s Foreign Minister, Semaya Kumba, on Monday that Juba needs to maintain “flexible and friendly relations” with Khartoum to safeguard its economic interests, especially oil exports. The diplomat added that Sudan believes Juba is facing internal pressure from officials linked to Abu Dhabi, including suggestions to construct medical facilities near the border to care for RSF fighters.

An economic researcher, Ahmed bin Omar, estimates that “Sudan suffered approximately $320 million in losses due to the halt in South Sudan’s oil exports during the conflict.” He suggests that the transportation of oil through Sudan has transitioned from being an economic benefit to a means of political leverage, with Port Sudan capable of threatening to stop exports when disputes escalate.

Oil fields in Sudan come under attack

The fields in West Kordofan, which have long been crucial to Sudan’s internal fuel supply, have experienced ongoing interruptions. While the military continues to manage the Heglig field, most nearby towns are now under the control of the RSF. Ayman Maldo, a worker at Heglig, mentioned that production has significantly decreased as companies dealing with operations face increasing insurance and operational expenses. “Production has dropped considerably due to the unstable situation, with operating companies increasing their costs,” Maldo stated. “Machinery expenses rose from $25,000 per day to double that during the conflict.”

Maldo stated that RSF drone attacks last month damaged control systems and essential equipment in Heglig. Oil companies are concerned that the strikes indicate the RSF’s preparations to take over the field and possibly advance east toward the remaining energy infrastructure in Port Sudan. “Companies feel things are very concerning, and they are taking risks in an area that could become a center of conflict at any moment,” Maldo added.

Researcher Hani Othman noted that the army’s loss of Babnusa on December 1 has heightened fears that the RSF is planning an attack on Heglig, the military’s final significant base in West Kordofan. He mentioned that businesses are not functioning at full capacity because of the uncertainty and the army’s failure to protect the region.

The RSF’s seizure of the Balila field in October 2023—previously generating 70,000 barrels daily but later dropping to 16,000 due to neglect and instability—added to the weakening of Sudan’s energy industry. Oil engineer Mohamed Abdo believes the Balila field contains at least 1.4 million barrels, yet conflict has significantly impaired the infrastructure that once supplied the Al-Jaili refinery in Khartoum North.

With domestic production declining, Sudan currently imports about 90% of its fuel, a significant shift from before the war when western sources met most of the local demand. Abdo mentioned that the RSF’s effort to take control of Babnusa is closely related to its location near Heglig—one of the few remaining major assets under government control.

Copyright 2025 Ayin Network. All rights reserved. Distributed by AllAfrica Global Media ().

Tagged: Sudan, Arms and Military Affairs, Legal and Judicial Affairs, East Africa, Conflict, Peace and Security

Provided by SyndiGate Media Inc.Syndigate.info).

Leave a comment