During the year-end “Santa rally” trend, stocks connected to quantum computers also managed to participate in the upward movement. Shares linked to quantum computing, which had faced substantial declines recently because of overly high expectations and rising worries about a potential bubble after the momentum from last October’s Nobel Prize, are now attracting more purchases at lower prices as views on excessive drops become more widespread.

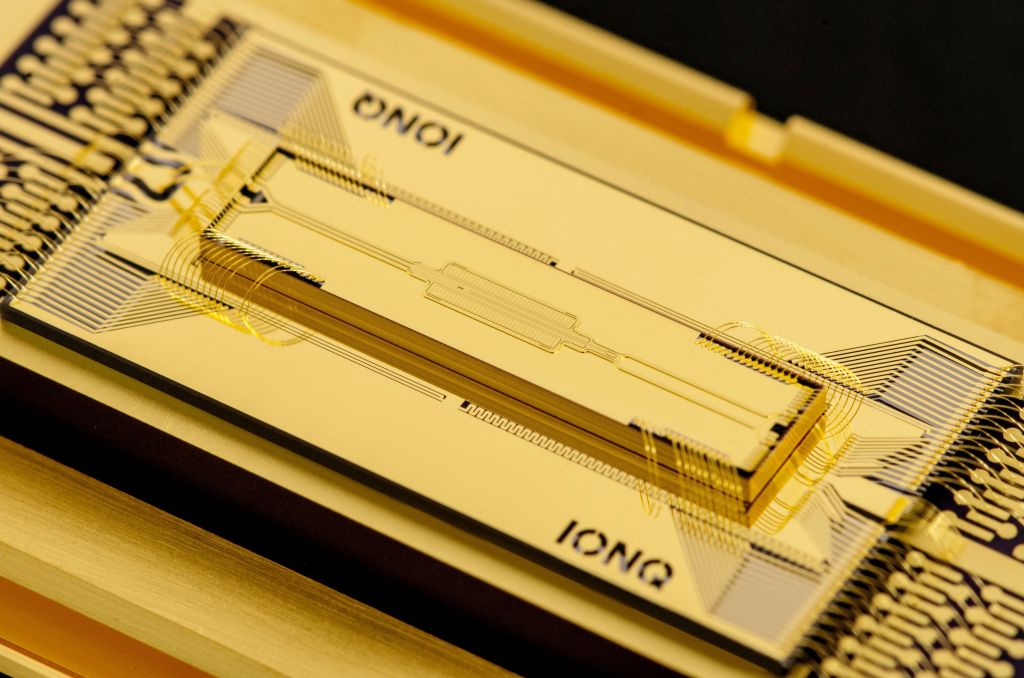

On the 22nd, IonQ, a top quantum computing stock listed on the New York Stock Exchange, increased by 11.1% from the previous trading day. Rigetti Computing, another key company in the field, also climbed by 13.2%, achieving double-digit gains.

Furthermore, D-Wave Systems increased by 20.0%, and Quantum Computing rose by 12.9%, as buying interest grew throughout the quantum computing sector. Experts point out that quick recoveries occurred in quantum computing stocks that had declined significantly during the recent market downturn.

Stocks associated with quantum computing experienced a rise in the latter part of this year following the Nobel Prize awarded to research in quantum mechanics and quantum information, which has raised hopes that they could serve as a “next-generation AI revolution.” Nevertheless, worries about the lengthy period needed for commercialization and the lack of clear revenue prospects led to a steep decline in stock prices.

IonQ and Rigetti both saw drops surpassing 40-50% from their peak in October. In recent times, they were unable to separate from the general AI stock downturn, displaying similar weakness. This situation increased fluctuations and reduced investor confidence, as per the analysis.

Nevertheless, a month ago, reports surfaced indicating that the Trump administration was examining stake acquisitions in quantum computing firms such as IonQ and Rigetti Computing, rekindling policy attention on quantum computing as a crucial national technological asset.

Furthermore, worries about the “Oracle shock”-induced AI bubble have somewhat eased, reducing valuation pressures on technology stocks as overly high expectations diminished. On the same day, the tech-focused Nasdaq Composite Index ended with a 0.5% gain, while the Philadelphia Semiconductor Index increased by 1.1%.

On Wall Street, the long-term assessments of quantum computing’s technological promise continue to hold strong. A U.S. financial services company, Wedbush, recently provided an “Outperform” rating for quantum computing stocks, noting, “Quantum computing has the potential to evolve into a groundbreaking technology when integrated with AI performance growth.”

Among quantum computing stocks, D-Wave Systems has recently drawn significant interest. As per the target prices set by Wall Street analysts, D-Wave Systems is projected to see an increase of up to 90% or higher by 2026 relative to its present stock value. Kevin Garrigan, an analyst at Pries, recently stated about D-Wave, “The company is set to begin 2026 with a strong financial standing and is anticipated to obtain enough capital to support its operational and technological development in the years ahead.”

Leave a comment