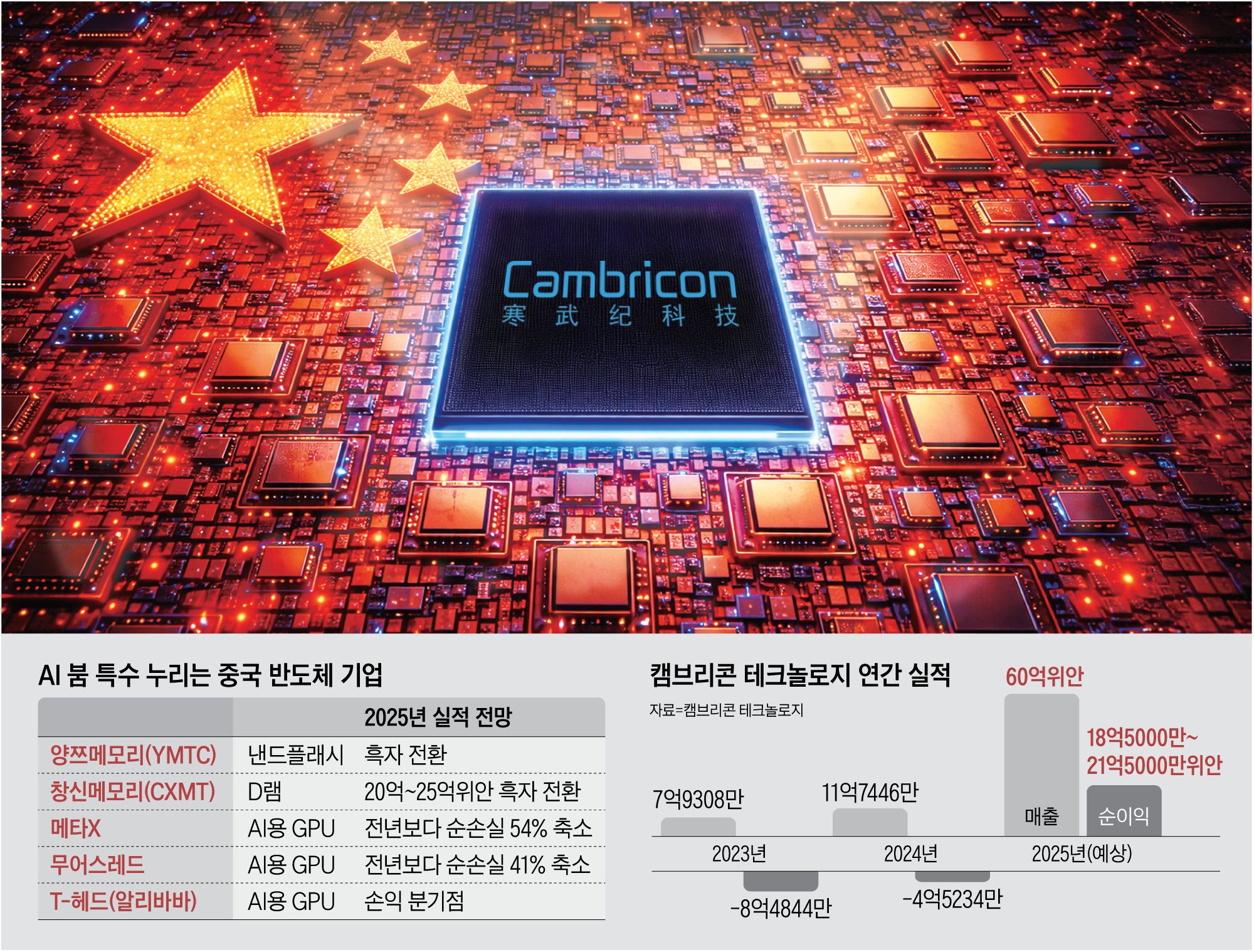

Cambricon Technology, a Chinese graphics processing unit (GPU) company that is competing with the “Chinese equivalent of NVIDIA,” revealed its 2025 revenue projection on the 30th of the previous month, stating, “Due to increased demand for artificial intelligence (AI), annual net profit is anticipated to range from 1.85 billion to 2.15 billion Chinese yuan (approximately 451.2 billion South Korean won).” This represents the first annual profit achieved by a Chinese GPU firm that depends exclusively on local demand, which had faced losses because of U.S. restrictions on semiconductors. Sinolang Finance described this as “a historic achievement demonstrating the market feasibility of Chinese semiconductor technology and indicating the beginning of a counteroffensive.”

The worldwide surge in AI is speeding up China’s ambition for “semiconductor independence.” Chinese major technology companies, unable to obtain advanced AI chips from American companies such as NVIDIA and AMD, are buying domestic GPUs in large quantities, boosting their revenue. Moreover, the shortage of memory semiconductors since late last year has provided chances for Chinese memory companies to enter international markets. Industry experts forecast, “As Chinese semiconductor companies start to make profits, they will increase their investments in research and development (R&D) and infrastructure.”

Prominent Chinese GPU companies, despite not being as profitable as Cambricon, experienced a dramatic increase in 2025 revenues, rising by several hundred percent, which greatly lessened their yearly losses.

Moore Threads, which debuted on the STAR Market (China’s equivalent of Nasdaq) in December 2025 as “China’s First GPU Stock,” announced on the 20th that its revenue for 2025 is expected to increase by 247% year-on-year to 1.52 billion yuan, while net losses are anticipated to decrease by up to 41% to 1 billion yuan. MetaX, which listed on the STAR Market two weeks following Moore Threads, also predicted revenue growth of more than 100% and a reduction in net losses by up to 54% to 798 million yuan. T-Head, an AI chip design subsidiary of Alibaba, does not provide financial forecasts as a private company, but industry analysts believe it may achieve profitability this year. The South China Morning Post (SCMP) reported, “T-Head’s advanced AI chip Zhenwu 810E, comparable to NVIDIA’s H20, has exceeded 100,000 units shipped,” and added, “T-Head’s semiconductor sales volume has surpassed Cambricon’s.”

Chinese memory semiconductor leaders are on a comparable path. NAND flash manufacturer Yangtze Memory Technologies Corp. (YMTC) and DRAM producer Changxin Memory Technologies (CXMT) are anticipated to achieve profitability in 2025, as per securities firms. These firms provide memory chips to Chinese major tech data centers and plan to enter global markets with mid- to low-end products, maintaining swift growth this year.

As Chinese semiconductor companies shift towards “market-driven” development, the rate of self-reliance within the industry is anticipated to increase. TrendForce, a market analysis company, predicts that the proportion of semiconductors manufactured domestically in China’s AI chip market will rise from 30% in 2024 to 50% by the end of this year. The U.S. Congressional Research Service (USCC) estimated in a November report that China may attain complete self-sufficiency in older semiconductor sectors by approximately 2030.

China’s emergence in the semiconductor sector presents a challenge to South Korea’s industry. Should U.S. sales of AI semiconductors decrease because of the expansion of Chinese GPU companies, the sales of high-performance memory products such as high-bandwidth memory (HBM) by local firms might also drop. A source within the semiconductor industry stated, “Chinese memory companies, now with substantial financial resources, are rapidly expanding their supply and may implement cost-effective strategies for standard products,” and added, “If the price growth for basic memory slows down, this could affect the profit margins of Samsung and SK.”

Leave a comment